The underlying assets on a CDS contract may vary. They are typically governments and corporations bonds, but they might include any financial instrument or index for which someone might want to buy protection, and for which someone might to sell it.

In the case that solvency of a sovereign or of an institution is being insured, the credit event is typically triggered by bankrupcy, but credit events might refer to a variety of other events, depending on the contract. Examples of other sources of credit event can be the downgrading of a credit rating, a fall in index level or share price, or even an natural disaster, such as a tsunami or an earthquake.

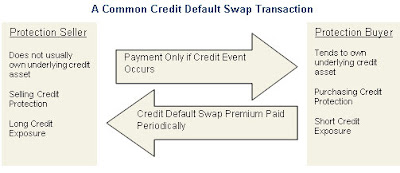

The only difference with traditional insurance is that the buyer of protection does not need to actually own the underlying asset.

Thus CDS are very flexible instruments that can be useful to the purpose of risk management. But how are they priced? As your intuition might suggest, they are traded openly and they have fluctuating prices. In the case that the underlying asset is a sovereing bond, the main fundamental factors used to assess the credit quality of the sovereing issuer are: the budget deficit, the debt-to-GDP ratio and the current account. (Criado, S. et al. 2010)

For further clarification of what these financial instruments are, follow this link:

No comments:

Post a Comment