Leave everything. Everything. Empty yourself. What remains? This means entering the realm of the subconscious, challenging the one and only, greatest opponent of them all: the human mind. Your mind. This is the supreme challenge, the very tip of the mountain that every man or woman in this world should aspire to reach. Having reached that level of self-awareness that enables you to aspire to Buddahood means renouncing to your individuality as you know it. Why? Because the mind has to reach the true essence of the self, the never-changing atman which is the opposite of our materialistic, superficial, ever-changing bodily self. One of the greatest teachings (one among the many great teachings) of ancient indian (vedantic) philosophy is that human consciousness is characterised by the existence of oppositions (good and evil, night and day, etc.) THE TRUE PURPOSE OF HUMAN EXISTENCE IS TO UNLOCK THE POTENTIAL WHICH RESIDES IN THE MIND, which can be done when the mind reaches the soul, ATMAN. This is the only way by which one can escape the circle of births and re-births that keeps the soul in this world. Until the soul is not ready to reach Nirvana, it will keep on coming back. The only way to reach the only real purpose of life, or state of liberation, or salvation, is to renounce to everything. Remember the song "imagine", by John Lennon?

Imagine no countries, it isn't hard to do. Nothing to kill or die for, and no religion too.

Imagine no possessions, I wonder if you can. No need for greed or hunger, a brotherhood of man.

I mean, do you guys realize how ahead of his time this guy was? He was describing the future of humanity. Because the realization of John Lennon's dream is the only way the human race can escape the circle of death brought by the craving of the material. Our aspirations have to be towards the reign of the mind, of self-awareness, away from the our material bodily state. Of course this is an incredibly tough path to follow, but we must achieve it. And what is the biggest obstacle to achieving that state of self-awareness of the human mind in today's society?

I will tell you what it is: it is the pre-confectioned happiness which is force-fed and sold to people in the Western society. It is the reason why traditional capitalism doesn't work. It's MTV, its Cristiano Ronaldo, its Nesquick, its the cheap Homer Simpson-faced flip flops that are being produced by slaves in the Laogai's in China and then are imported by the big western corporations and sold to western consumers. Its the brainwashing that we receive every day, on the tube when we go to work, on the tube when we get back home, on the tv when we turn it on, on youtube when we watch a video, on the sides of our Facebook wall where we are updated every second about what shoes our friend just bought, or just how waisted our other friend got at the party on Friday night. Disinformation. That is what they rely on to keep us stupid. Bombarding us with disinformation.

In a capitalist society the powerful and the decision-making individual (i.e. corporations' shareholders and government officials) wants to retain learns from a young age that his only aspirations are related to the material (become wealthier),

The capitalist (or oligarchs) in a capitalist society, by appropriating social status to the average consumer, creates and shapes the individual. Social engineering. This shit has been going down for a looooong time now. But more on that in future posts.

The Economics of Cosmic Law

I know I am an idealist, so what? Let me dream of my world of shared beliefs and collective moral consciousness. A world where man knows, believes and lives by cosmic law. For I believe that good moral principles are by necessity the foundation of any kind of constructive knowledge, and thus that of economics and business in particular, because of the extremely important role that these play in our lives...

Friday, 26 April 2013

Monday, 28 November 2011

Italy's challenge

As we all know very well, yields on Italian bonds surged dramatically this year. This represents a huge problem for an economy that has debt levels currently around 125% of GDP, because of the increased cost the government incurres in financing its debt. You can imagine what this means in terms of money loss, given the fact that the sovereign has a public debt that amounts to €1.9 trillion. Take a look at this chart.

Recently there has been discussion about the fact that yields would have gone even higher had the ECB not been buying large quantities of Italian debt. This is something very disturbing because it tells just how much global investors have lost confidence in Italy's ability to serve its debt. All of a sudden people are percieving Italy as much riskier than they used to. So I asked myself: why is this happening? Why all of a sudden there is a lack of confidence in my countries' capability to remain solvent?

Recently there has been discussion about the fact that yields would have gone even higher had the ECB not been buying large quantities of Italian debt. This is something very disturbing because it tells just how much global investors have lost confidence in Italy's ability to serve its debt. All of a sudden people are percieving Italy as much riskier than they used to. So I asked myself: why is this happening? Why all of a sudden there is a lack of confidence in my countries' capability to remain solvent?

If we look at the Italian bond yield chart and we listen to what the news suggests (the English media in particular) we might come to the conclusion that this is the result of a sudden and unexpected problem. One might argue that bond yields surged this much because of uncertainty about the future of the Eurozone due to the bad financial situation that certain Eurozone sovereigns are facing. Although this factor was definitely one of the causes, I believe that it is not the only one. The problems are many and they are not only financial, but there are also political and social causes behind Italy's problems. Eventually all of this ended with Italy "losing its face" in the global environment because of media magnate Silvio Berlusconi's ackwardness and excessive italian-style humor that wasnt understood by the International press and political world, came at a wrong time and from the wrong person (you cant be a prime minister and a jester at the same time, even though it worked out to hook up the Italian voters) (Apparently). =P

Other causes that lead to he current situation are excessive legislative bureaucracy, which serves as an obstacle to the much needed FDI by slowing processes and "social division" between sustainers of Berlusconi and sustainers of the opposition, the socialist party, with the result of a country that isnt united, a problem for the country both at a national and international level. In the last elections Berlusconi won by a handful of votes. Almost half of the population wasnt happy with the previous ruling political party. This might be one of the causes of another major problem that Italy is facing, i.e. the loss in competitiveness of Italian firms in the global market. Eventually Berlusconi had to resign.

The new PM, Mario Monti, is the dean of Italy's most prominent economics university, an expert in economics and the financial markets.

I think that because the most important goal that Italy has to achieve right now is to lower its borrowing cost it is crucial that investors re-gain confidence in the Italian market and start re-buying Italian debt. The current yield level on 10yr bonds is unsustainable in the long term. Just think that an auction on November 29th commanded a 7.89% return on three-year bonds!

The appointment of a technocratic government was a first step towards the solution. Now it is up to Monti and his government to convince the markets further by imposing much needed austerity measures that will make him extremely unpopular in Italy but might be the only way to save Italy and Europe from the disaster that a breakout of the Eurozone would lead to in terms of GDP, real incomes, unemployment and inflation.

The new PM, Mario Monti, is the dean of Italy's most prominent economics university, an expert in economics and the financial markets.

I think that because the most important goal that Italy has to achieve right now is to lower its borrowing cost it is crucial that investors re-gain confidence in the Italian market and start re-buying Italian debt. The current yield level on 10yr bonds is unsustainable in the long term. Just think that an auction on November 29th commanded a 7.89% return on three-year bonds!

The appointment of a technocratic government was a first step towards the solution. Now it is up to Monti and his government to convince the markets further by imposing much needed austerity measures that will make him extremely unpopular in Italy but might be the only way to save Italy and Europe from the disaster that a breakout of the Eurozone would lead to in terms of GDP, real incomes, unemployment and inflation.

Friday, 18 November 2011

CDS explained part 2. Why are they important to us??

The main goal of credit default markets is to establish market prices for a given default risk. As in all other markets, the market price of a CDS is established based on on the law of supply and demand.

The credit default swap market plays a huge role in financial speculation nowadays. Depending on how risky (depending on the possibility of bankrupcy or possibility of default on debt) investors percieve a sovereign to be, they will decide if they want to bet in its favour, insuring its solvency, i.e. sell protection on a CDS (and thus recieving premiums) or bet against it, buying protection, thus paying the periodical premium (because they expect a credit event to happen, which mean that they would recieved the notional amount specified on the contract (usually $10million).

The rate of payments made per year by the buyer is known as the CDS spread. If there are more buyers than sellers in the market, the spread widens, meaning that it will cost more to buy protection on that particular CDS. 100 basis points equal a 1% interest.

Now lets look at what are known as the CDS market "hot charts" on sovereign debt:

These charts above have been the source of all these rumours we have been hearing from friends, we have been reading on facebook, twitter, and now even in the news! (meaning its now no more a taboo to talk about it!) about a possibility of a collapse of the eurozone.

Did he just say it? Yes- I said it. What these charts mean is that more and more speculators are buying protection on these sovereigns and less are selling it- meaning that more people are expecting a credit event to occur. For example right now someone buying protection on italy has to pay 5.5% interest per year on the notional amount of a contract to the seller of insurance. If, for example, the notional amount of a contract is $10million, the buyer will have to pay $550000 per annum to the seller in interests until maturity. Should the pre-specified credit event occur, however, the seller of protection deliveres to the buyer of the CDS the notional amount of the contract, $10million in exchange.

The reason why the credit default swap market is so important to international investors and expecially to sovereigns is because of the very high correlation that credit defaults swap spreads have with sovereign bond yields. Just look at these charts:

Therefore investors holding sovereign bonds issued by troubled economies (such as the piigs) or speculators willing to enter this high-risk (but also with high profit potential) trade should always keep an eye on the CDS markets, to try to anticipate market moves and be able to act on their credit risk exposure to these economies.

Thursday, 10 November 2011

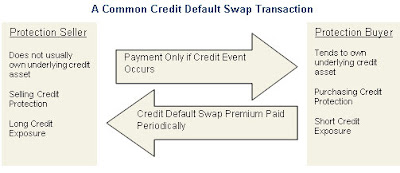

CDS explained part 1. What are credit default swaps??

Since the collapse of Lehmann Brothers on the 15th of September 2008, we have been hearing increasingly more about credit default swaps. But what exaclty are these?

A credit default swap is conceptually a sort of insurance. The way a CDS works is really simple. First of all, whoever buys a CDS is buying an insurance on something. The buyer of insurance then pays a premium (interest) to the seller of protection periodically. In the case a credit event should occur, which is a pre-specified event that triggers the default of the contract, the seller of insurance has to deliver the notional amount specified on the contract to the buyer of protection in exchange for the underlying credit asset. This is the ONLY case in which the CDS seller pays the buyer. If a credit event does not occur, the contract expires at maturity.

The underlying assets on a CDS contract may vary. They are typically governments and corporations bonds, but they might include any financial instrument or index for which someone might want to buy protection, and for which someone might to sell it.

In the case that solvency of a sovereign or of an institution is being insured, the credit event is typically triggered by bankrupcy, but credit events might refer to a variety of other events, depending on the contract. Examples of other sources of credit event can be the downgrading of a credit rating, a fall in index level or share price, or even an natural disaster, such as a tsunami or an earthquake.

The only difference with traditional insurance is that the buyer of protection does not need to actually own the underlying asset.

Thus CDS are very flexible instruments that can be useful to the purpose of risk management. But how are they priced? As your intuition might suggest, they are traded openly and they have fluctuating prices. In the case that the underlying asset is a sovereing bond, the main fundamental factors used to assess the credit quality of the sovereing issuer are: the budget deficit, the debt-to-GDP ratio and the current account. (Criado, S. et al. 2010)

For further clarification of what these financial instruments are, follow this link:

The underlying assets on a CDS contract may vary. They are typically governments and corporations bonds, but they might include any financial instrument or index for which someone might want to buy protection, and for which someone might to sell it.

In the case that solvency of a sovereign or of an institution is being insured, the credit event is typically triggered by bankrupcy, but credit events might refer to a variety of other events, depending on the contract. Examples of other sources of credit event can be the downgrading of a credit rating, a fall in index level or share price, or even an natural disaster, such as a tsunami or an earthquake.

The only difference with traditional insurance is that the buyer of protection does not need to actually own the underlying asset.

Thus CDS are very flexible instruments that can be useful to the purpose of risk management. But how are they priced? As your intuition might suggest, they are traded openly and they have fluctuating prices. In the case that the underlying asset is a sovereing bond, the main fundamental factors used to assess the credit quality of the sovereing issuer are: the budget deficit, the debt-to-GDP ratio and the current account. (Criado, S. et al. 2010)

For further clarification of what these financial instruments are, follow this link:

Wednesday, 2 November 2011

Global commodity price inflation and food prices

A commodity price index is a tipical indicator used to calculate changes in inflation. It is a weighted average of selected commodity prices. These commodities are usually taken from different categories of goods, such as energy, metals and agricultural goods. Here is a tipical commodity chart:

By looking at it it is clear that prices of goods have increased dramatically in the last 20 years.

Now let's focus just on food prices. It shows that most agricultural goods have increased in price since by almost 60 % from 2006 to 2008. (Trostle, R. 2008). http://www.ers.usda.gov/Publications/WRS0801/WRS0801.pdf

We can deduce that agricultural commodities were among those goods that pushed prices up.

So what is the reason for the dramatic food price increase starting in 2006 up to 2011? The law of supply&demand would have us believe that people were buying much more than they were selling, but was this really the case?

Reasearch from the U.S. department of agriculture shows that there were many possible causes that could have led to food price inflation. Population and economic growth, rising per capita meat consumption (which in turn pushes up the price of wheat or other agricultural commodities used to feed animals), slowing growth in agricultural production, rapid expansion in biofuels production, dollar devaluation and rising production costs are among the most commonly accepted factors driving up prices.

The problem with this is that it fuells speculation-as investors expect prices to rise in the future, they buy commodity futures and this pushes prices up even more. So the result is that that speculators worsen a situation that is already dangerous. Just think about the consequence that such a food price inflation has on people living in thirld world and developing countries.

By looking at it it is clear that prices of goods have increased dramatically in the last 20 years.

Now let's focus just on food prices. It shows that most agricultural goods have increased in price since by almost 60 % from 2006 to 2008. (Trostle, R. 2008). http://www.ers.usda.gov/Publications/WRS0801/WRS0801.pdf

We can deduce that agricultural commodities were among those goods that pushed prices up.

Reasearch from the U.S. department of agriculture shows that there were many possible causes that could have led to food price inflation. Population and economic growth, rising per capita meat consumption (which in turn pushes up the price of wheat or other agricultural commodities used to feed animals), slowing growth in agricultural production, rapid expansion in biofuels production, dollar devaluation and rising production costs are among the most commonly accepted factors driving up prices.

The problem with this is that it fuells speculation-as investors expect prices to rise in the future, they buy commodity futures and this pushes prices up even more. So the result is that that speculators worsen a situation that is already dangerous. Just think about the consequence that such a food price inflation has on people living in thirld world and developing countries.

Thursday, 27 October 2011

Cosmic Law explained!

History teaches us that after the fall of the Berlin wall a time of World peace started. The history we learn in school does. But it is not until we learn about economics and finance that we understand that the war never ended. The battlefield and the weapons changed, but the conflict remains open. Today more than ever.

Instead of battles being fought by soldiers in open fields, in the sea or in the air, those who now fight the battles are traders, financial engineers, lawyers. The battlefields are the markets and the courtrooms. Instead of wars being won using guns or tanks, weapons in the REAL wars include lawsuits, advertising, debt, derivatives and other financial tools such as models.

The reason why there was a change in warfare is because society has "legalized" wars. Rather than kingdoms and states actually fighting each other on the battlefield for the land, resources and labour, now Corporations fight wars to increase their market share, to maximise shareholder´s weath.

In a capitalist society, who has the most capital is the most powerful. As a result, corporations now rule the world, not governments. And corporations prefer to fight wars in the legal way. At least officially.

If you are more interested in what I am talking about, listen to this speech from president Kennedy just a few weeks before his death. http://www.youtube.com/watch?v=bj3AECSKmhU

Lawsuits are the most obvious type of wars between corporations. Recently the Samsung vs. Apple case has become very famous, and I think it is a great example of one of the "market share wars" I was talking about just now, http://www.foxnews.com/scitech/2011/09/23/samsung-vs-apple-war-hits-high-gear/

Advertising is THE "mass-brainwashing weapon". I use the term brainwashing rather than convincing because of the enourmous amount of advertising we are forced to cope with every day.

Advertising is THE "mass-brainwashing weapon". I use the term brainwashing rather than convincing because of the enourmous amount of advertising we are forced to cope with every day.

Derivatives and financial models are of the same nature of advertising, I believe. Too often they have been misused by huge financial institutions like in the case of the sub-prime mortgage crisis. I believe these financial instruments can be used for good and can help the progress of our society. Of course it is up to the users themselves to chose how to use them (think about financial deregulation in the U.S.)

Debt can also be a positive instrument as long as all debtors play by the same rules, meaning there are no corporations or individuals too big to fail. Otherwise, as has been argued in the documentary "Inside Job", if you are too big to fail, you are too big to exists.

We know how it can end up if there isn´t enough regulation and control of operations in the financial industry. We have seen it in the mortgage crisis in the U.S. and are now witnessing it in the E.U., e.g. the taxpayer in Greece having to pay for the mistakes that "experts" in the financial industry did when they allowed Greece to enter the Eurozone.

Cosmic law is a Hinduist belief. It is the law that governs the universe, the engine that keeps the universe moving. The fuel that powers this engine is love. Everyone has the choice of living within the law or outside it. In the end, you and only you are going to benefit from living by it.

Of course living by the rule is hard and the path to become a better person is long. He who attains living by the rule becomes a happier person. He gets to know his inner-self. Knowing your inner-self (or spirit) brings you happiness. The more conscious you are of your spirit, the less attached you are to the material world, the more you understand that materiality is not the true source of happiness.

Now where exactly does this fit with business practice?

Should it? What do you think?

Instead of battles being fought by soldiers in open fields, in the sea or in the air, those who now fight the battles are traders, financial engineers, lawyers. The battlefields are the markets and the courtrooms. Instead of wars being won using guns or tanks, weapons in the REAL wars include lawsuits, advertising, debt, derivatives and other financial tools such as models.

The reason why there was a change in warfare is because society has "legalized" wars. Rather than kingdoms and states actually fighting each other on the battlefield for the land, resources and labour, now Corporations fight wars to increase their market share, to maximise shareholder´s weath.

In a capitalist society, who has the most capital is the most powerful. As a result, corporations now rule the world, not governments. And corporations prefer to fight wars in the legal way. At least officially.

If you are more interested in what I am talking about, listen to this speech from president Kennedy just a few weeks before his death. http://www.youtube.com/watch?v=bj3AECSKmhU

Lawsuits are the most obvious type of wars between corporations. Recently the Samsung vs. Apple case has become very famous, and I think it is a great example of one of the "market share wars" I was talking about just now, http://www.foxnews.com/scitech/2011/09/23/samsung-vs-apple-war-hits-high-gear/

Advertising is THE "mass-brainwashing weapon". I use the term brainwashing rather than convincing because of the enourmous amount of advertising we are forced to cope with every day.

Advertising is THE "mass-brainwashing weapon". I use the term brainwashing rather than convincing because of the enourmous amount of advertising we are forced to cope with every day.

The idea of advertising is in itself genuine, providing consumers with information about the product, but the volume of advertising we are exposed to and the way sex is often exploited to sell products show that corporations utilise it in an immoral, and thus wrong, way.

Derivatives and financial models are of the same nature of advertising, I believe. Too often they have been misused by huge financial institutions like in the case of the sub-prime mortgage crisis. I believe these financial instruments can be used for good and can help the progress of our society. Of course it is up to the users themselves to chose how to use them (think about financial deregulation in the U.S.)

Debt can also be a positive instrument as long as all debtors play by the same rules, meaning there are no corporations or individuals too big to fail. Otherwise, as has been argued in the documentary "Inside Job", if you are too big to fail, you are too big to exists.

We know how it can end up if there isn´t enough regulation and control of operations in the financial industry. We have seen it in the mortgage crisis in the U.S. and are now witnessing it in the E.U., e.g. the taxpayer in Greece having to pay for the mistakes that "experts" in the financial industry did when they allowed Greece to enter the Eurozone.

Cosmic law is a Hinduist belief. It is the law that governs the universe, the engine that keeps the universe moving. The fuel that powers this engine is love. Everyone has the choice of living within the law or outside it. In the end, you and only you are going to benefit from living by it.

Of course living by the rule is hard and the path to become a better person is long. He who attains living by the rule becomes a happier person. He gets to know his inner-self. Knowing your inner-self (or spirit) brings you happiness. The more conscious you are of your spirit, the less attached you are to the material world, the more you understand that materiality is not the true source of happiness.

Now where exactly does this fit with business practice?

Should it? What do you think?

Friday, 14 October 2011

A turning point for European markets?

The Slovak parliament approved the expansion of the European Financial Stability Fund (EFSF) yesterday. As a result, markets in the Eurozone can finally take a deep breath. After a period of indecision from August to October (see below) as can be seen by observing the volatility of the German DAX (Deutscher Aktien IndeX) and the French CAC 40, confidence in the market seems to be restored. These two indexes are considered the most representative of economic performance in the Eurozone.

DAX

DAX

CAC 40

The EFSF’s objective is to preserve financial stability of Europe’s monetary union by providing temporary financial assistance to euro area Member States in financial difficulty.

With the approval of the EFSF by the Slovakian government, the fund has now increased its powers and size. It can now directly buy government bonds, providing help to sovereigns and recapitalizing banks.

The Slovak EFSF approval resulted in investors showing confidence in the European market because of limited downside effects in the short run. Even if Greece should default on its debt, a possibility that has been the main source of market volatility, the fund will provide European banks that have credit exposure to Greek debt with liquidity needed to continue with business operations.

The fund provides insurance against eventual bankruptcies that could otherwise take place in such a scenario. It is backed by the sovereign governments of the Eurozone and by the IMF. So far its main use has been providing cash to heavily indebted economies in the Eurozone. These “bailouts”, term that has been used to describe funds received by troubled economies since the sovereign debt crisis began in April 2010, are needed to provide liquidity in the markets so that normal economic activity may continue. But they come at a high price.

The economies that benefit from the fund must implement “austerity measures”, i.e. policies that aim to decrease their deficits by cutting back on public spending, jobs, but also other areas such as healthcare and education, and sovereigns can only access the funds when proof has been shown that radical changes are being pursued.

So far the economies which needed these bailouts have been Greece, Portugal and Ireland. In some cases, the austerity measures can be so tough on the taxpayer that people have raised serious concerns about these policies and we are all left to imagine what frustration could lead to.

So far the economies which needed these bailouts have been Greece, Portugal and Ireland. In some cases, the austerity measures can be so tough on the taxpayer that people have raised serious concerns about these policies and we are all left to imagine what frustration could lead to.

In the end it is the taxpayers that have to pay the highest price, and even though the current situation in these countries isn’t only one person’s fault, I believe that the people don’t realize that and prefer blaming politicians. So in their minds that makes them the victims of a situation they had nothing to do with, demotivating them from putting in the effort and making the sacrifices that are much needed if they want the situation to improve.

The fund provides insurance against eventual bankruptcies that could otherwise take place in such a scenario. It is backed by the sovereign governments of the Eurozone and by the IMF. So far its main use has been providing cash to heavily indebted economies in the Eurozone. These “bailouts”, term that has been used to describe funds received by troubled economies since the sovereign debt crisis began in April 2010, are needed to provide liquidity in the markets so that normal economic activity may continue. But they come at a high price.

The economies that benefit from the fund must implement “austerity measures”, i.e. policies that aim to decrease their deficits by cutting back on public spending, jobs, but also other areas such as healthcare and education, and sovereigns can only access the funds when proof has been shown that radical changes are being pursued.

So far the economies which needed these bailouts have been Greece, Portugal and Ireland. In some cases, the austerity measures can be so tough on the taxpayer that people have raised serious concerns about these policies and we are all left to imagine what frustration could lead to.

So far the economies which needed these bailouts have been Greece, Portugal and Ireland. In some cases, the austerity measures can be so tough on the taxpayer that people have raised serious concerns about these policies and we are all left to imagine what frustration could lead to. In the end it is the taxpayers that have to pay the highest price, and even though the current situation in these countries isn’t only one person’s fault, I believe that the people don’t realize that and prefer blaming politicians. So in their minds that makes them the victims of a situation they had nothing to do with, demotivating them from putting in the effort and making the sacrifices that are much needed if they want the situation to improve.

Subscribe to:

Comments (Atom)